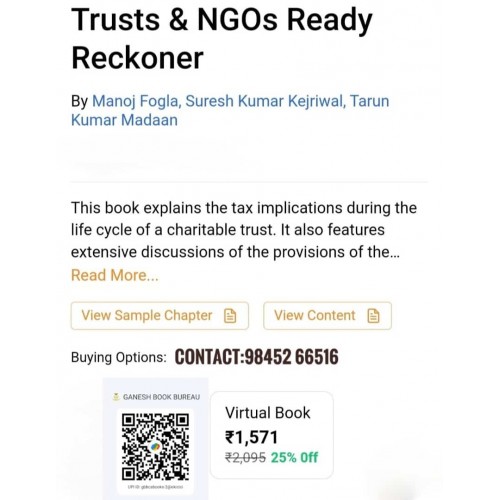

TRUSTS & NGOS READY RECKONER |VIRTUAL BOOK

Description

This book explains the tax implications during the life cycle of a charitable trust, starting from incorporation, registration, maintenance of books of account, scheme of taxation, computation of income, filing of the income-tax return, audit report, cancellation of registration, forfeiture of exemption, etc. It contains an extensive discussion of the provisions of the Income-tax Act, tutorials and guides on filing various forms under the Act.

This book is an essential resource for anyone interested in the legal landscape surrounding trusts & NGOs, containing a comprehensive collection of landmark rulings on all controversial issues.

The Present Publication is the 4th Edition and has been amended by the Finance Act 2023. This book is authored by Dr Manoj Fogla, CA Suresh Kumar Kejriwal & CA Tarun Kumar Madaan, with the following noteworthy features:

- [Clear & Accessible Language] is followed throughout this book

- [Analysis & Impact of Amendments] by the Finance Act 2023

- [Exhaustive Coverage of the Registration & Approval Process] under the following Sections:

- Section 12AB

- Section 10(23C)

- Section 80G

- [Explanation to the Scheme of Taxation & Computation of Income] of NGOs

- [Practical Guide] for the following:

- Filing Registration Application