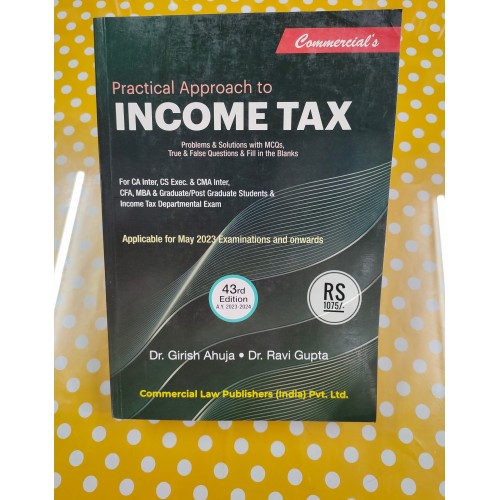

PRACTICAL APPROACH TO INCOME TAX BY GIRISH AHUJA & RAVI GUPTA

Click Image for Gallery

Description

Practical Approach to Direct & Indirect Taxes (Income Tax and GST) contains Problems & Solutions with MCQs, True & False questions & Fill in the Blanks. It is useful for CA inter IPC, CS executive & CMA Inter, CFA, MBA & Graduate / Post Graduate Students & Income Tax Departmental Exam.

Highlights of the Book

- The aim of the book is to help and enable the readers in understanding the intricate problems relating to Income Tax and GST.

- Even the last minute changes in the law have been incorporated in the book and it is, therefore, the latest and most upto date book for the Assessment Year 2023-2024. The amendments made by the Finance Act, 2022 have been incorporated at appropriate places in the book.

- A unique feature is that each Chapter contains summarised provisions in the beginning, to give a bird s eye view of the subject and to quickly recapitulate the important points.

- A novel feature of this book is that it contains 1200+ Multiple Choice Questions, 300+ True or False Questions, 200+ Fill in the Blanks and 500+ Problems & Solutions, which will help students to recapitulate the concepts of direct and indirect taxes.

- The Practical Problems include selected questions from the examinations of various Universities and Professional Institutes.

- The book is useful for the students appearing in CA Inter-IPC, CS Exec., CMA Inter and CFA examinations. It will also be useful for graduate/ post graduate students of various Universities and Management Institutes as well as the Departmental examinations of the Income-Tax Department.